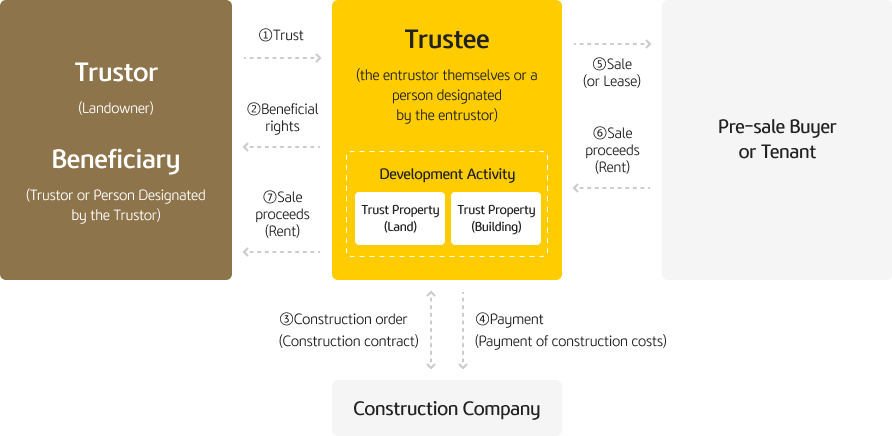

A trust product in which a trust company receives land in trust from a customer who lacks construction funds or development know-how and conducts the entire process of development projects, including establishing a development plan, procuring construction funds, managing construction, and selling and leasing buildings, and returns the profits generated to the landowner (beneficiary).

| Classification | Borrowed | Managed | Main Features |

|---|---|---|---|

| Main Features | Borrowed | ① Trust company finances business expenses ② Obligation to carry out the project as the property owner ③ Trust company risk is high ④ Trust fee rate is high | ①The business owner directly bears the responsibility for financing the project ②The risk is relatively low for the trust company. ③ Fiduciary fees are relatively low |

| Managed | ①The business owner directly bears the responsibility for financing the project ②The risk is relatively low for the trust company. ③ Fiduciary fees are relatively low |

※ There may also be cases where borrowing-type and management-type are mixed. It is classified into sales-type and rental-type based on the disposal method.

* [Trust Fee Criteria] Please refer to the above trust fee rate. Detailed criteria are disclosed on our website (http://www.kbret.co.kr).