※ Minimum capital within 6 months of business license: Self-managed REITs 7 billion KRW, Entrusted/Corporate Structure REITs:5 billion KRW.

Distribution to investors

※ Remuneration criteria : Decision to be negotiated in the asset management contract between the REIT and the Company (Type of remuneration : Asset purchase fee, asset management fee, asset disposal fee, performance fee, etc.)

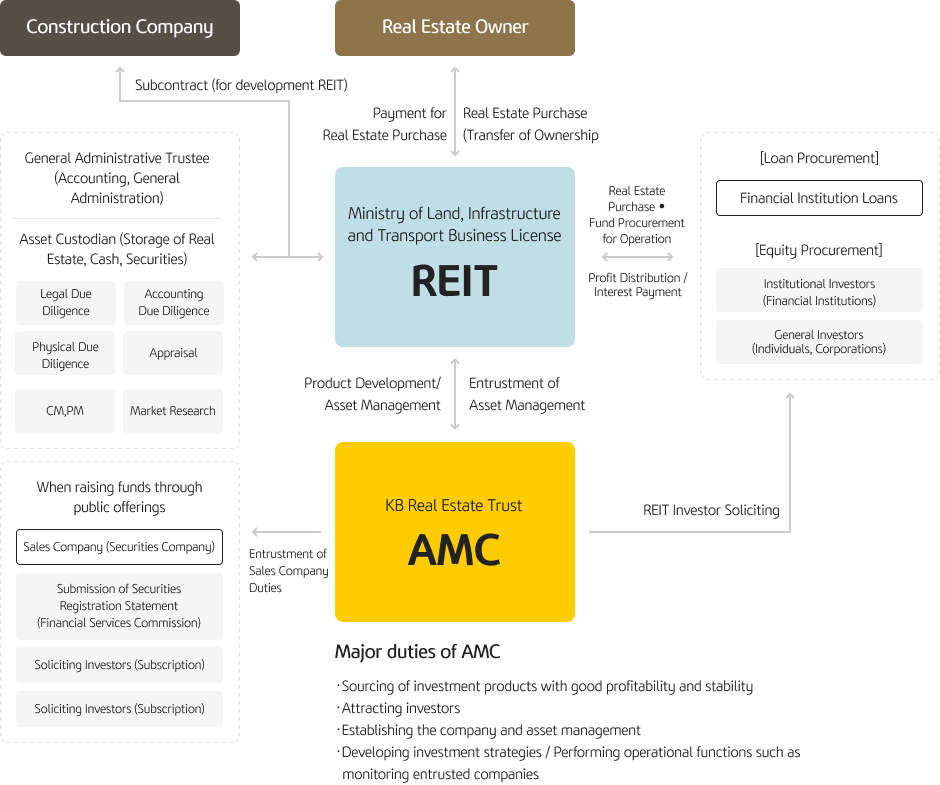

* AMC : Asset Management Company (KB Real Estate Trust was licensed by the Ministry of Land, Infrastructure, and Transport in 2002)

| Classification | Self-managed REITs | Trust-managed REITs | Corporate Reorganization REITs (CR-REITs) |

|---|---|---|---|

| Corporate | Tangible company | Company on paper | Company on paper |

| Overview | A corporation under commercial law that specializes in real estate investment, has full-time employees including asset management professionals, and directly carries out the investment and management of assets. | A company that entrusts the investment and management of assets to an asset management company and does not require full-time employees, essentially a paper company. | A paper company in the form of a mutual fund specializing in corporate restructuring real estate, where the investment and management of assets are entrusted to an asset management company. |

| Investment target | · General Real Estate · Development Project | · General Real Estate · Development Project | · Real estate for corporate restructuring · Development Project |

| Classification | Trust-managed REITs |

|---|---|

| Corporate | Company on paper |

| Overview | A company that entrusts the investment and management of assets to an asset management company and does not require full-time employees, essentially a paper company. |

| Investment target | · General Real Estate · Development Project |

| Classification | Corporate Reorganization REITs (CR-REITs) |

|---|---|

| Corporate | Company on paper |

| Overview | A paper company in the form of a mutual fund specializing in corporate restructuring real estate, where the investment and management of assets are entrusted to an asset management company. |

| Investment target | · Real estate for corporate restructuring · Development Project |

※ A development-specialized REIT is a REIT that invests 100% in development projects, established in the forms of [Development-Specialized Self-Managed REIT], [Development-Specialized Trustee-Managed REIT], and [Development-Specialized Corporate Restructuring REIT].

* CR-REIT : Corporate Restructuring Real Estate Investment Trust