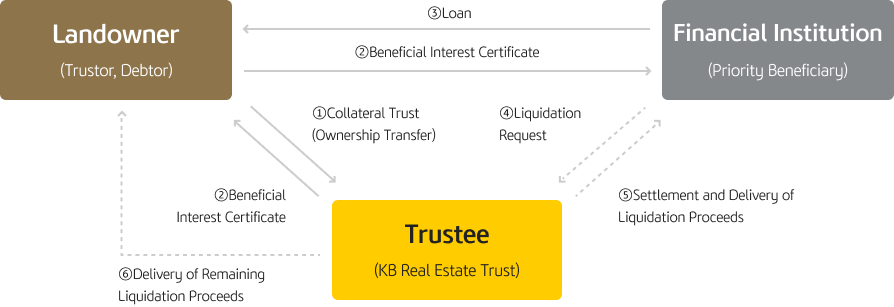

Trust products for borrowing money using real estate, such as land and buildings, as collateral.

※Trust fee criteria

| Public auction by the trust company through collateral trust | Court auction through mortgage※ | |

|---|---|---|

| Public auction by the trust company through collateral trust | Duration: Possible within as short as approximately 30 days. · Receipt of liquidation request from the financial institution: 1 to 2 days · Performance demand: 20 days (can be shortened by priority beneficiary request) · Public auction notice: Public auction can be conducted after 10 days have passed since the auction notice | Duration: Approximately 8 months · Auction Start Decision-Dividend Request Period: 3 months · Sale Decision - Payout: 3 months · Dividend Distribution : 2 months ※ The duration may be subject to change depending on the court or other circumstances. |

| Court auction through mortgage※ | Duration: Approximately 8 months · Auction Start Decision-Dividend Request Period: 3 months · Sale Decision - Payout: 3 months · Dividend Distribution : 2 months ※ The duration may be subject to change depending on the court or other circumstances. |

Bank A handled a loan for Company A using our collateral trust beneficiary certificate as security. However, due to Company A's bankruptcy and application for court receivership, the loan is at risk of becoming non-performing. In response, Bank A inquired about the debt recovery method, and we informed them that the real estate under collateral trust was not subject to asset preservation disposal. Following the request from the financial institution, we promptly conducted a public auction, preventing the financial institution from incurring non-performing loans.

Company E planned to secure a loan from Financial Institution B by providing its company-owned real estate as collateral. However, the collateral properties were scattered across multiple locations, and some of the properties had complex legal relationships in progress, leading to concerns about whether they could be accepted as collateral. Upon hearing about this situation, the loan officer at the financial institution instructed Company E to entrust the collateral to our company. In response, we provided an appropriate solution for the real estate with complex legal relationships, took custody of each property, and quickly issued a beneficiary certificate based on this. As a result, Company E was able to secure the loan easily.

Company C, facing a delay in the expected influx of funds at the end of last year, urgently needed financing. After intense efforts, they were able to secure the desired collateralized loans from three financial institutions. However, for Company C, the costs associated with procedures such as mortgage establishment for each financial institution were significant. More importantly, due to the time constraints, they were at risk of not receiving the funds in a timely manner. In this situation, after being introduced by the financial institutions, Company C entrusted the collateral trust to our company. We quickly completed the registration process and issued beneficiary certificates to the three financial institutions, enabling Company C to secure the loan at the necessary time and with minimal cost.